Office of the Commissioner for Federal Judicial Affairs Canada

Quarterly Financial Report for the quarter ended December 31, 2020

Statement outlining results, risks, and significant changes in operations, personnel, and program

1. Introduction

This Quarterly Financial Report (QFR) has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board of Canada Secretariat. This QFR should be read in conjunction with the Main Estimates and Supplementary Estimates. It has not been subject to an external audit or review.

1.1 Mandate

The Office of the Commissioner for Federal Judicial Affairs (FJA) Canada was created in 1978 under the authority of the Judges Act to safeguard the independence of the judiciary and in order to put federally appointed judges at arm’s length from the administration of the Department of Justice. FJA’s mandate extends to promoting better administration of justice and providing support for the federal judiciary.

FJA administers three distinct and separate components that are funded from different sources. Statutory funding is allocated for the judges’ salaries, allowances and annuities, and surviving beneficiaries’ benefits. Voted appropriations are provided in two separate votes to support the administrative activities of FJA and the Canadian Judicial Council (CJC).

Under the Departmental Results Framework, the organization’s core responsibility is to provide support to federally appointed judges. In addition to Internal Services, the organization is broken down into three program activities: payments pursuant to the Judges Act, FJA, and CJC.

Further details about FJA’s authority, mandate, and programs can be found below and in FJA’s Departmental Plan (DP), Main Estimates and Supplementary Estimates located on FJA’s and the Treasury Board’s websites at www.fja-cmf.gc.ca and www.tbs-sct.gc.ca.

1.2 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes FJA’s spending authorities granted by Parliament and those used by the department consistent with the Main Estimates for the 2020-2021 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

FJA uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter and fiscal year to date (YTD) results

FJA is financed by the Government through Parliamentary Appropriations (e.g. Statutory Votes for payments pursuant to the Judges Act and Employee Benefits Plans (EBP) and Budgetary Votes to support the administration of FJA and CJC).

Vote-netting is a means of funding selected programs or activities wherein Parliament authorizes FJA to apply revenues collected towards costs directly incurred for specific activities. FJA has the authority to spend revenues received during the year arising from the provision of administrative services.

Changes to Departmental Authorities

As at December 31, 2020, the total authorities available to FJA increased by $42 million compared with the same quarter last fiscal year. This net increase is comprised of:

- An increase of $41.9 million in statutory authorities for judges salaries, allowances and annuities.

- An increase of $0.1 million in operating budget mainly due to the receipt of the 2019-20 Year End Operating Budget Carry Forward (OBCF), compared to the previous year’s OBCF.

Changes to Budgetary Expenditures

As at December 31, 2020 the department’s total net budgetary expenditures increased by $2 million compared with the same quarter last fiscal year. This variance is comprised of:

- A year-to date net decrease of $14 million in transportation and telecommunications expenditures.

- A year-to date net increase of $13.7 million in personnel expenditures (including EBP and judges’ salaries, annuities, and surviving beneficiaries’ benefits issued pursuant to the Judges Act).

- A year-to date net increase of $3.3 million in professional services expenditures.

- A year-to date net decrease of $0.8 million in other subsidies and payments expenditures.

- An overall net decrease of $0.2 million for all other non-salary expenditures.

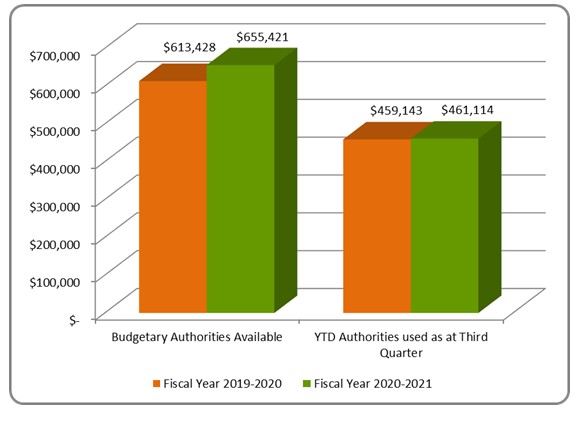

Figure 1: Comparison of Authorities Granted and Used

The chart illustrates the variation in thousands of dollars of the annual budgetary authorities granted and used as at December 31, 2019 and 2020.

As at December 31, 2019 and 2020, FJA planned to spend $613,428,049 in 2019-20 and $655,421,061 in 2020-21. Authorities used as at the third quarter totalled $459,142,842 in 2019-20 and $461,113,549 in 2020-21.

3. Risks and Uncertainties

FJA’s environment is complex due to the range of services it provides and the large number of clients served. Recognizing this context, FJA has developed a risk profile and actively monitors internal and external risks through its management team. Concise information about significant financial risks and uncertainties, the potential impact to FJA’s 2020-21 financial plan and the strategies adopted to manage these financial risks and uncertainties are briefly outlined below. Further detail about FJA’s internal and external risks can be found in FJA’s 2020-21 DP.

This QFR reflects the results of the current fiscal period in relation to the authorities available as at December 31, 2020.

FJA continues to operate within its existing reference levels, which have remained relatively constant for several years. The lack of new funding and the focus on addressing gaps and deficiencies at the operating level has limited FJA’s ability to make investments in new strategic priorities. FJA has responded to these challenges by reallocating internal resources and identifying efficiencies, however, the ability to continue to do so is limited.

4. Significant changes in relation to operations, personnel and programs

As at December 31, 2020, travel restrictions imposed by the COVID-19 pandemic have resulted in a significant decrease in expenses related to transportation.

5. Approval by Senior Officials

Original signed by:

Marc A. Giroux

Commissioner

Ottawa (Canada)

Date: February 24, 2021

Original signed by:

Errolyn Humphreys

Chief Financial Officer

Ottawa (Canada)

Date: February 24, 2021

Statement of Authorities (unaudited)

Fiscal year 2020-2021 (in thousands of dollars)

|

|

Total

available for use for the year ending |

Used

during the quarter ended |

Year- to-date used at quarter-end |

|

Vote 1 – FJA – Operating expenditures |

9,329 |

2,555 |

6,811 |

|

Vote 5 – CJC – Operating expenditures |

2,283 |

479 |

1,501 |

|

Less: Vote 1 – FJA – Revenues |

(275) |

(10) |

(20) |

|

Net Operating expenditures |

11,337 |

3,024 |

8,292 |

|

Statutory authorities - EBP |

937 |

234 |

703 |

|

Statutory authorities – Judges salaries, allowances and annuities |

643,147 |

147,479 |

452,119 |

|

Total Budgetary Authorities |

$ 655,421 |

$ 150,737 |

$ 461,114 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.

Fiscal year 2019-2020 (in thousands of dollars)

|

|

Total

available for use for the year ending |

Used

during the quarter ended |

Year to date used at quarter-end |

|

Vote 1 – FJA – Operating expenditures |

9,392 |

2,649 |

6,684 |

|

Vote 5 – CJC – Operating expenditures |

2,092 |

777 |

1,789 |

|

Less: Vote 1 – FJA – Revenues |

(275) |

(10) |

(20) |

|

Net Operating expenditures |

11,209 |

3,416 |

8,453 |

|

Statutory authorities - EBP |

957 |

235 |

705 |

|

Statutory authorities – Judges salaries, allowances and annuities |

601,262 |

150,946 |

449,985 |

|

Total Budgetary Authorities |

$ 613,428 |

$ 154,597 |

$ 459,143 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental budgetary expenditures by Standard Object (unaudited)

Fiscal year 2020-2021 (in thousands of dollars)

|

Planned

expenditures for the year ending |

Expended

during the quarter ended |

Year-to-date used at quarter-end |

|

|

Expenditures |

|||

|

Personnel -including EBP |

612,301 |

144,861 |

444,663 |

|

Transportation and Telecommunications |

21,626 |

1,825 |

3,687 |

|

Information |

109 |

17 |

54 |

|

Professional Services |

15,363 |

3,052 |

8,758 |

|

Rentals |

237 |

36 |

173 |

|

Purchased Repair and Maintenance |

36 |

3 |

17 |

|

Utilities, materials and supplies |

56 |

4 |

17 |

|

Acquisition of Machinery & Equipment |

218 |

8 |

18 |

|

Other subsidies and payments* |

5,750 |

941 |

3,747 |

|

Total Gross Budgetary Expenditures |

655,696 |

150,747 |

461,134 |

|

Less Revenues netted against Expenditures |

|||

|

Revenues |

(275) |

(10) |

(20) |

|

Total net budgetary expenditures |

$ 655,421 |

$ 150,737 |

$ 461,114 |

Fiscal year 2019-2020 (in thousands of dollars)

|

|

Planned

expenditures for the year ending |

Expended

during the quarter ended |

Year-to-date used at quarter-end |

|

Expenditures |

|||

|

Personnel - including EBP |

570,427 |

145,167 |

430,978 |

|

Transportation and Telecommunications |

23,600 |

6,139 |

17,677 |

|

Information |

138 |

42 |

106 |

|

Professional Services |

12,455 |

1,910 |

5,454 |

|

Rentals |

388 |

112 |

260 |

|

Purchased Repair and Maintenance |

121 |

99 |

102 |

|

Utilities, materials and supplies |

73 |

8 |

20 |

|

Acquisition of Machinery & Equipment |

83 |

5 |

58 |

|

Other subsidies and payments* |

6,418 |

1,125 |

4,508 |

|

Total Gross Budgetary Expenditures |

613,703 |

154,607 |

459,163 |

|

Less Revenues netted against Expenditures |

|||

|

Revenues |

(275) |

(10) |

(20) |

|

Total net budgetary expenditures |

$ 613,428 |

$ 154,597 |

$ 459,143 |

*Timing difference – actual expenditures used during the quarter include interdepartmental settlements that were coded to the appropriate standard object in subsequent accounting periods.

- Date modified: